Application to benefit from consumer loan subsidy is done only through the eKosova platform

20.10.2021, Pristina

Ministry of Finance, Labour and Transfers of the Republic of Kosovo started implementing Measure 3.6 to support household liquidity which means subsidizing consumer loans. Therefore, all bank customers and the general public are informed that when applying for consumer loans in their bank they must follow the standard application procedures. The commercial banks will also follow the standard loan evaluation and approval procedures when processing loan applications. Consequently, banks will not prejudge the approval or not of loan subsidy and will not have any special procedure or additional information regarding this measure. In case of loan approval, the customer should contact the eKosova platform where they can fill in the necessary forms.

The following are the instructions published by the Ministry of Finance:

Who can benefit?

All persons receiving consumer loans up to the amount of 10,000 Euro, from 1 October 2021 onwards, will be able to apply for a loan subsidy.

What is the amount of the subsidy?

The amount that each qualifying applicant benefits is 10% of the loan amount, up to a maximum of 300 euros.

Example:

If the loan is 1,500 Euro, the subsidy will be 150 Euro;

If the loan is 3,000 Euro, the subsidy will be 300 Euro;

If the loan is 5,000 Euro, the subsidy will be 300 Euro.

What do you need to do to benefit?

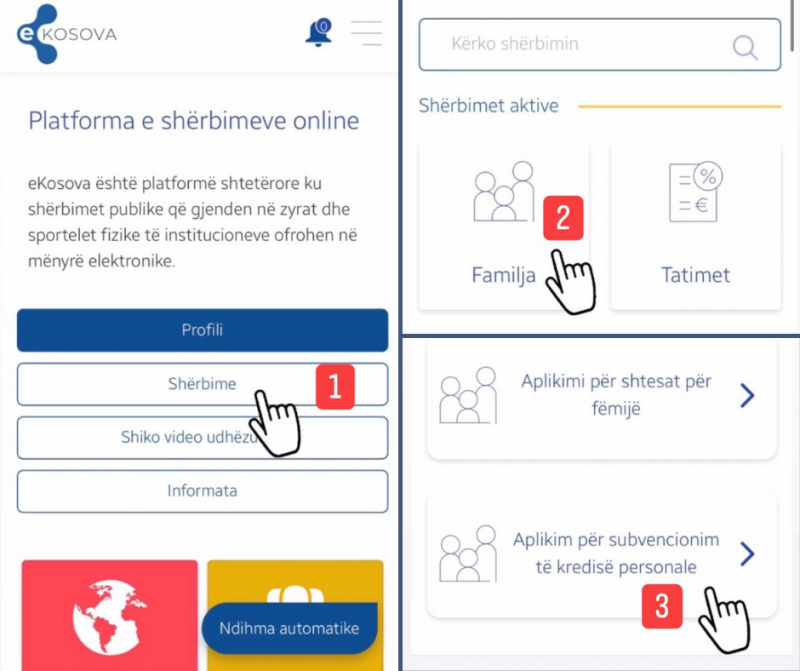

Once you have received a loan from a licensed financial institution, you must complete the eKosova application form.

After confirming the accuracy of the application, the subsidy is paid into the borrower’s bank account.

This measure aims at supporting household liquidity to cover seasonal family expenses, school expenses, closing credit card balances, or any other expenses that would alleviate to a certain extent the family burden.